Client Services

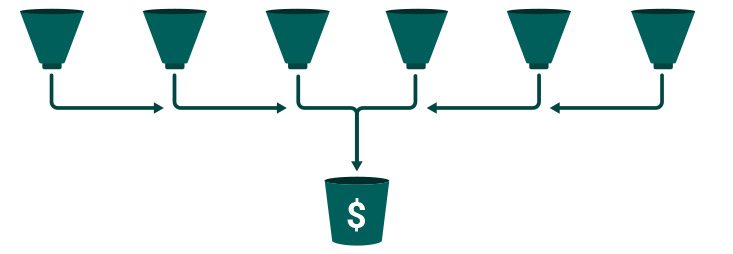

We work to simplify your financial life by consolidating

and coordinating your retirement income sources

Consolidation of Your Retirement Income

Besides just simplicity and convenience, consolidating your retirement income into one account helps your investments work together for more effective retirement income planning.

Social Security

- Disability

- Spousal Benifits

- Survivor Benifits

Pensions

- PERS

- Corporate Plan

- DB Plan

Retirement Plans

- 401(k)

- 403(b)

- IRA

- SEP

Investments

- Individual Account

- Trust Account

- Joint Account

- Savings

Income

- Employment

- Deferred Compensation

- Business

- Rentals

Other

- Inheritance

- Stock Options

- Insurance

Your Monthly Income

We take a comprehensive approach to wealth management and create specific strategies to address your important issues.

Critical Wealth Planning Needs

At Anderson Wealth Management Group, we are committed to providing you with informed perspectives and tailored approaches to your needs and challenges. As your trusted advisor, we begin with a deep understanding of your financial priorities and then apply appropriate financial strategies to help you optimize your wealth. Together, we can explore your needs regarding wealth planning as we work to help build, manage, preserve and transfer your wealth.

Your investment plan

- - Assess your risk tolerance

- - Rebalance or reposition assets as needed

Retirement assets and company benefits

- - Retirement plan investments

- - Stock option grants or restricted stock

Personal risk

- - Adequate insurance protection

- - Management plan for incapacity/disability

Access to Banking and Lending Services through Wells Fargo affiliates

- Through our Wells Fargo affiliates, you have access to lending products and services, including:

- - Securities-based financing

- - Residential mortgages

- - Home equity financing

- - Business financing

- - Credit cards

Cash flow/cash reserve

- - Emergency funds

- - Cash alternatives

Wealth preservation strategies

- - Types of ownership; beneficiary designations

- - Wealth preservation strategies

Income tax planning

- - Identify tax-efficient portfolio strategies

- - Manage capital gains, losses and alternative minimum tax (AMT) exposure

Charitable and community giving

- - Select suitable charitable techniques

- - Instill philanthropic values in the next generation

Independent women

- - Financial advice and decision-making guidance

- - Planning to help achieve new goals

- Wells Fargo Advisors does not provide legal or tax advice, but your Financial Advisor will be happy to work with your chosen legal and tax advisors to help you achieve your financial goals.

- Insurance products are offered through non bank insurance agency affiliates of Wells Fargo & Company and are underwritten by unaffiliated insurance companies. Lending and other banking services available through the Lending & Banking Services Group of Wells Fargo Advisors (NMLS UI 2234) are offered by banking and non-banking subsidiaries of Wells Fargo & Company, including, but not limited to Wells Fargo Bank, N.A. (NMLSR ID 399801), Member FDIC, and Wells Fargo Home Mortgage, a division of Wells Fargo Bank, N.A. Certain restrictions apply. Programs, rates, terms, and conditions are subject to change without advance notice. Products are not available in all states. Licensed by New Hampshire banking department.